Are SaaS pricing models keeping up with how modern teams actually use software? As AI-driven workflows become the norm and procurement teams tighten budgets, buyers in 2026 are no longer satisfied with static pricing tiers or generic seat-based plans. They want pricing that’s fair, flexible, and tied to real usage—not inflated bundles or idle licenses.

In this article, we explore how SaaS buyer expectations are evolving, the rise of usage-based and hybrid pricing models, and which structures are winning trust in the market. Whether you’re building for startups, scaling for enterprise, or rethinking your own pricing strategy- this guide breaks down what SaaS buyers really want in 2026.

Why Pricing Models Matter More Than Ever in 2026

Pricing has become a defining part of the SaaS value proposition in 2026, not just a commercial detail. Buyers now scrutinise pricing with the same seriousness as product capabilities because it directly affects cost predictability, operational planning, and long-term ROI. When a pricing model doesn’t reflect how teams actually use the product, it creates financial uncertainty, slows adoption, and limits expansion.

What’s Driving the Shift?

SaaS buyers expect pricing to match workflow maturity, team structure, automation intensity, and seasonal usage patterns. Models that ignore these realities lead to poor adoption, lower expansion rates, and higher churn, turning pricing into a strategic differentiator rather than a billing mechanism.

1. Uneven AI Adoption Across Teams

AI usage varies widely across departments. Some rely heavily on automated actions, while others use AI sparingly. Fixed subscriptions don’t address this imbalance, often forcing low-usage teams to subsidise higher-usage teams. Buyers now prefer pricing that scales with measurable consumption.

2. Finance Teams Want Costs Tied to Actual Value

CFOs are pushing back against flat-fee models because they rarely reflect true usage. They favour pricing that aligns spend with operational demand and supports predictable planning. Consumption-based structures prevent overpayment during quieter periods while ensuring flexibility during peak cycles.

3. Visibility Into “Shadow Tools” Has Exposed Waste

Renewal audits continue to uncover large amounts of unused licenses, inactive modules, and duplicate tools. This has created demand for transparent pricing with real-time usage visibility. Buyers want the ability to track consumption, reallocate resources, and avoid paying for features that deliver no value.

4. Procurement Needs Predictability and Stability

Procurement teams now apply strict criteria around clarity and cost stability. Hidden meters, vague thresholds, and volatile billing patterns are major red flags. Vendors that offer clear usage limits, predictable renewals, and transparent cost structures move through approval cycles much faster.

What Is Usage-Based Pricing (UBP)?

Usage-based pricing (UBP) is a commercial model in which customers pay based on measurable consumption rather than fixed seats or predefined feature bundles. Instead of a flat monthly fee, organizations are charged for quantifiable activity such as API calls, automated workflows run, data processed, reports generated, or AI actions performed. The key advantage is alignment: total spend reflects actual product usage.

This creates a clear link between operational output and cost, allowing companies to scale software expenses up or down based on actual usage patterns.

Why It Gained Popularity

UBP grew rapidly alongside the rise of AI, data, and infrastructure-heavy products. Industry leaders like OpenAI, Snowflake, Twilio, Stripe, and Mixpanel helped normalize consumption-based billing by proving that:

- It supports scalability

- It adapts to unpredictable demand

- It provides transparent value attribution

Usage-based pricing works especially well for SaaS products where consumption varies widely across customers or where value is directly tied to volume, throughput, or automation intensity.

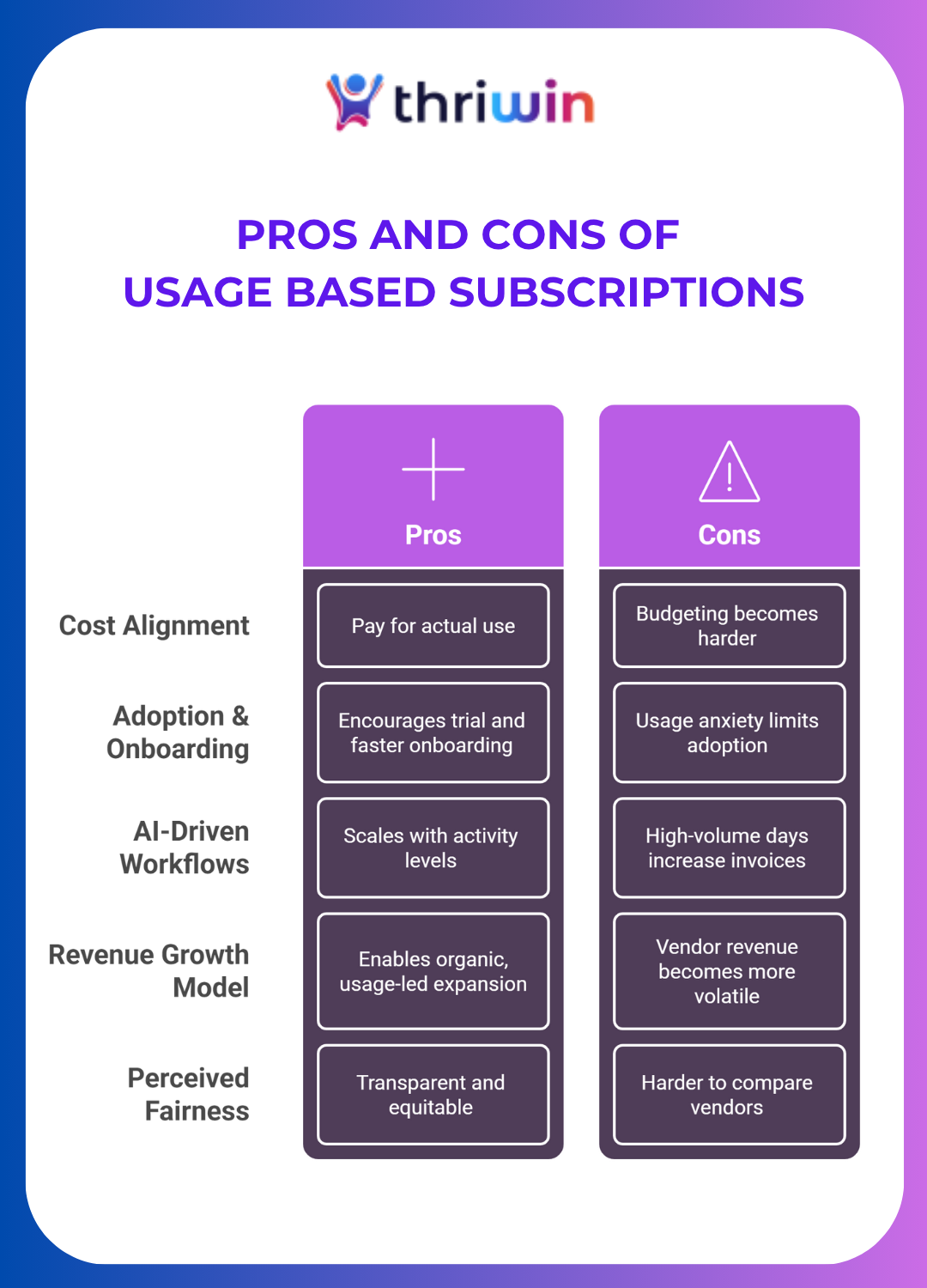

Usage-Based Pricing: Pros and Cons

Usage-based pricing allows companies to pay strictly for what they use. Costs are tied to measurable actions, such as API calls, workflows executed, data processed, or AI outputs, so spend scales directly with actual consumption.

To see where usage-based pricing works best and where it falls short, there’s a clear breakdown of its key pros and cons:

What Are Fixed Subscriptions?

Fixed subscriptions are pricing models where customers pay a predictable monthly or annual fee for access to a defined set of features, capacity limits, or user seats. These plans are typically structured as Basic, Professional, and Enterprise and offer cost stability for buyers and simplify budgeting, forecasting, and procurement.

Each tier provides a fixed set of entitlements, with higher tiers unlocking more advanced capabilities. This model has dominated SaaS for more than a decade because it delivers consistent revenue for vendors and reliable costs for customers. Fixed subscriptions work especially well for tools with steady usage patterns, collaborative workflows, and team-based environments where value is driven by continuous engagement rather than variable consumption.

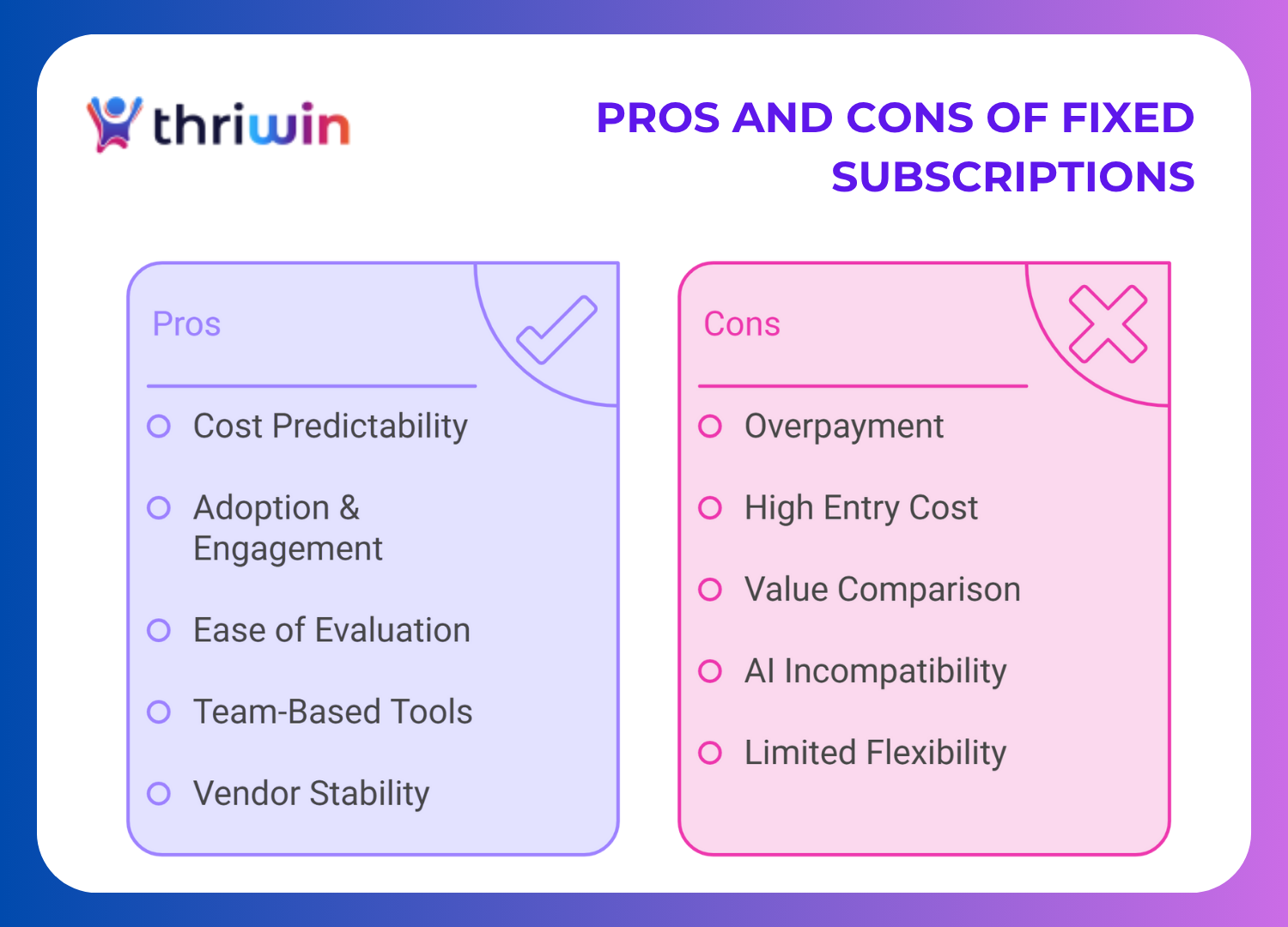

Fixed Subscriptions: Pros and Cons

Fixed subscriptions remain a strong choice for many SaaS products because they offer predictable, easy-to-budget pricing. They work especially well for collaborative tools with steady, team-based usage.

To understand where fixed subscriptions shine and where they fall short, here’s a quick comparison of their key pros and cons.

What SaaS Buyers Really Want in 2026 (Based on SERP Trends)

Insights from leading pricing studies, including Paddle, OpenView, SaaStr, Chargebee, and McKinsey, indicate a major shift in how SaaS buyers evaluate pricing models in 2026. Buyers are moving away from rigid, one-size-fits-all subscriptions and toward models that reflect real usage, workflow maturity, and financial responsibility. What they want most is fairness without complexity, and scalability without unpredictable costs.

1. Predictability + Flexibility

Buyers expect a stable base fee paired with flexible, usage-linked components. This hybrid structure reduces financial anxiety, ensures heavy users pay their fair share, and prevents low-usage teams from overpaying. It keeps budgets controlled while still allowing costs to scale with measurable value.

2. Transparent Pricing With No Hidden Meters

Hidden AI credit meters, unclear thresholds, and unexpected overages are now top procurement blockers. Buyers expect complete clarity into how consumption is measured and billed. Real-time dashboards showing usage, forecasted spend, and remaining capacity have become essential for internal reporting and financial governance.

3. Modular Pricing Based on Actual Needs

Organizations want the freedom to buy only the capabilities relevant to their workflow, whether that’s compliance automation, email outreach, analytics, or AI agents. Modular pricing avoids bloated plans filled with unused features and aligns spend with current operational priorities while leaving room for future expansion.

4. Pricing That Matches Growth Stage

Different company sizes require different pricing logic.

- Startups want low-commitment entry points.

- Mid-market teams need scalable plans with predictable jumps.

- Enterprises expect volume discounts and stable, long-term agreements.

Buyers want pricing that adapts to their maturity, not a single structure forced across all business stages.

5. Value-Based Tiers Instead of Seat Counts

More buyers now evaluate pricing based on outcomes, automated workflows, completed tasks, processed data, or business impact rather than the number of users. Seat-based models feel outdated for AI-powered tools where value is tied to output rather than headcount. Value-aligned tiers are viewed as more equitable and better reflect how modern SaaS products deliver results.

Why Hybrid Pricing Models Are Winning in 2026

Hybrid pricing combining a fixed subscription with usage-based components has become the preferred model for leading SaaS companies in 2026. It strikes the balance buyers now expect: predictable baseline costs with scalable, usage-linked value. As AI-driven workflows and fluctuating consumption patterns become standard across teams, hybrid models deliver the control buyers want without limiting vendors' revenue potential.

How Hybrid Pricing Works

Hybrid pricing blends two structures into one:

- A predictable base fee for stable access to core features

- Usage-based charges for consumption-heavy or AI-driven actions

AI-intensive products often include credits for specific tasks, while collaborative tools maintain seat-based access for consistency. This model is widely used across platforms like Notion AI, OpenAI Teams, Zendesk, Slack, and HubSpot’s operations suite, each combining subscription stability with flexible usage economics.

Why Buyers Prefer It

Buyers choose hybrid pricing because it delivers the best of both worlds:

- Cost stability through a fixed base plan

- Fairness as spend increases only when usage (and value) grows

- Control through clear thresholds and predictable billing.

- Scalability that adapts to workflow intensity and automation levels

This combination of predictability and flexibility has made hybrid pricing the dominant standard for modern SaaS products in 2026.

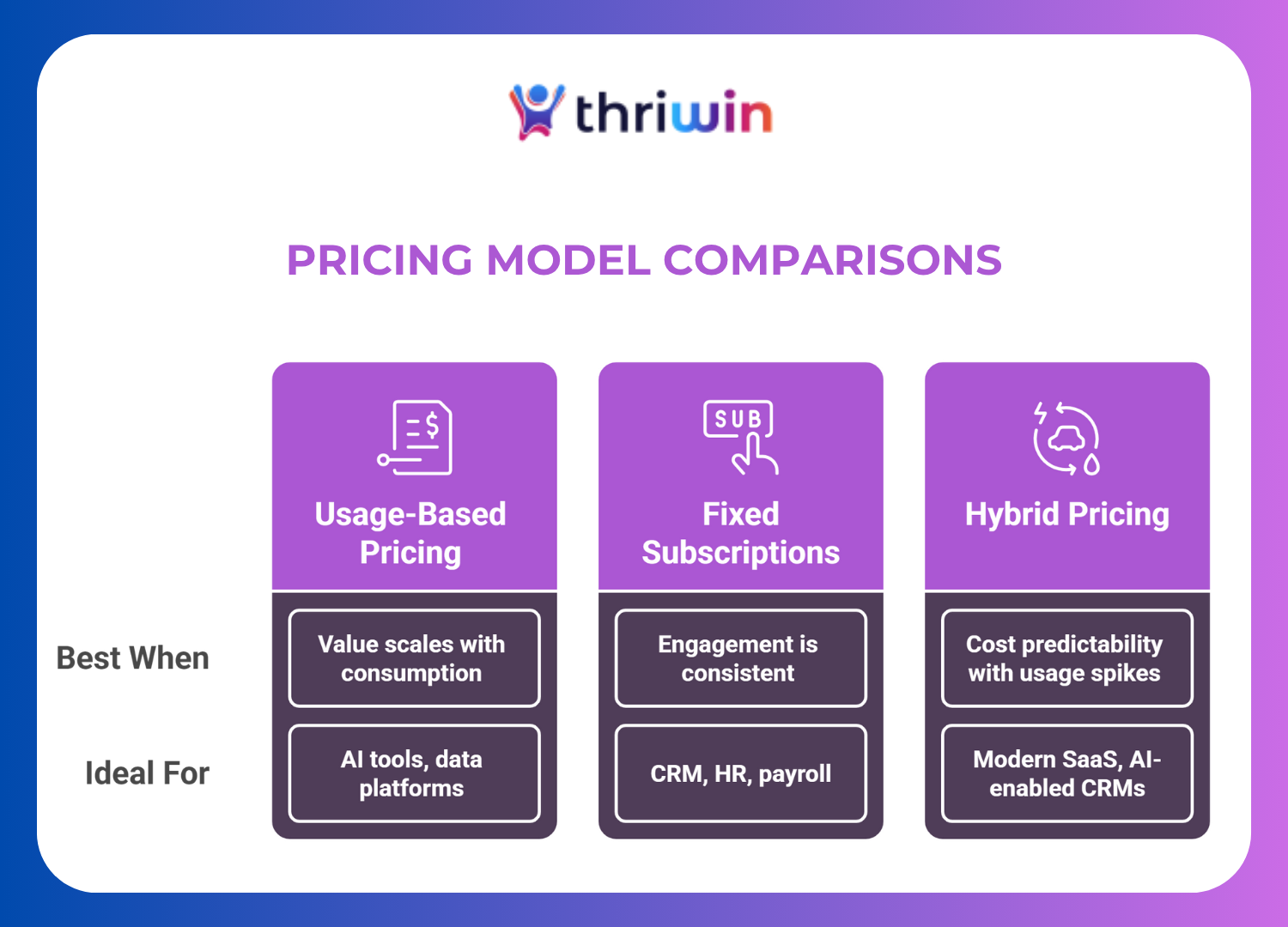

Which Model Should SaaS Companies Choose?

Choosing the right pricing model depends on how customers use your product, how predictable their workloads are, and how value scales across teams. The best model is the one that mirrors real usage patterns, not the one that’s easiest to package.

Pricing Trends SaaS Buyers Expect in 2026

Industry data from OpenView, Paddle, SaaStr, and McKinsey shows that SaaS buyers in 2026 are gravitating toward pricing structures that offer predictability, transparency, and clear value attribution. As AI adoption accelerates, companies want pricing models that reflect real usage, minimize financial risk, and support scalable growth.

1. More AI-Credit Pricing

AI-driven products are shifting to hybrid models in which customers pay a stable subscription fee, supplemented by AI credits for specific actions. This approach separates core platform access from high-intensity AI operations, making spending easier to justify and forecast.

2. Transparent Usage Dashboards

Buyers now expect real-time visibility into how consumption translates into cost. Modern pricing expectations include dashboards that provide usage analytics, cost alerts, and projected monthly spend so teams can manage budgets proactively and avoid billing surprises.

3. Unlimited Starter Plans

Teams increasingly prefer low-commitment entry points that allow them to adopt the product without metering anxiety. Unlimited starter tiers remove friction during onboarding, help users explore features freely, and accelerate early-stage activation.

4. Outcome-Based Add-Ons

Pricing is gradually shifting toward modules tied to measurable outcomes, such as conversions, tasks completed, or workflows automated. This ensures buyers pay for tangible business impact rather than abstract entitlements or seat counts.

5. Seatless Pricing Models

More platforms are moving away from user-based pricing and adopting value metrics, such as the number of automations executed, data processed, or actions performed. Seatless models better reflect how AI and automation tools create value, especially in environments where headcount no longer correlates with usage.

Final Thought

The future of SaaS pricing isn’t about choosing between usage-based or fixed subscriptions; it’s about offering the right model at the right moment for the right user. As teams adopt AI, automate workflows, and seek more measurable ROI from their tools, pricing becomes a reflection of trust, alignment, and long-term value.

Hybrid models are winning in 2026 because they combine predictability with flexibility, giving buyers the confidence to scale without financial surprises, and giving vendors the levers to grow revenue in step with customer success. The key is clarity: make it easy for buyers to understand what they’re paying for, and why it’s worth it.

Ready to Build Pricing That Works as Your Product Does?

At Thriwin, we help SaaS teams design pricing that reflects real usage, reduces buyer resistance, and scales with success.

Explore our modular, usage-aligned pricing engine and see how we’re helping high-growth companies get paid for real value, not unused features.

🔗 Book a Demo or visit www.thriwin.io to learn more.

FAQs

Is usage-based pricing cheaper than fixed subscriptions?

Not always. Usage-based pricing can be cheaper for light or inconsistent users, but heavy users may end up paying more than a fixed plan. The advantage is that teams only pay for what they use, making it cost-efficient for early or unpredictable usage patterns.

Why are SaaS companies shifting to hybrid pricing?

Hybrid pricing gives buyers predictability through a base fee and flexibility through usage add-ons. It works well for AI-driven tools, where usage varies daily. Companies adopt hybrid models to reduce churn, improve buyer confidence, and support scalable revenue.

Which industries prefer usage-based pricing?

API-first, AI, developer tools, data platforms, and compliance automation tools use usage-based pricing most effectively. These industries experience fluctuating usage patterns, making pay-per-use pricing more equitable than fixed subscription pricing.

Do enterprise buyers prefer fixed or usage pricing?

Enterprises prefer predictable costs, so fixed or hybrid models usually win. However, for AI workloads, compliance tasks, and data-heavy operations, enterprises may prefer usage pricing for specific modules while keeping the rest under a fixed or hybrid plan.

How do I know which pricing model fits my SaaS product?

Choose a model based on how your users behave. If engagement is steady and team-based, fixed pricing works best. If usage varies or scales with output, usage-based fits better. For mixed behavior or AI-driven workflows, hybrid pricing offers the best balance.

%201.svg)